Why Your Operating Model Is a Financial Liability

The annual plan is no longer enough in volatile markets. Even when finance teams add rolling forecasts and frequent reallocations, capital still gets stuck in yesterday’s priorities. Supply shocks and erratic demand move faster than reporting cycles, so decisions rely on outdated data, and the company reacts only after the market has shifted.

While many leaders are attempting redesigns, multi-year, big-bang digital transformations have high failure rates, and value erodes fast unless you deliver change iteratively. The only durable path is to build for continuous change. This is the promise of the composable enterprise: a business assembled from modular capabilities, not rigid processes. It’s the difference between a buy-and-hold bond basket and an actively managed fund that constantly reallocates to where value is created now.

But this agility creates a profound finance problem: how to maintain control without centralisation?

Agility Without Losing Financial Control

Pushing decisions to the edge is necessary for speed, but it raises the risk of strategic drift. When many teams can redeploy resources, the CFO can lose line of sight to EBITDA targets. Without a connective nervous system from strategy to execution, a composable company is simply a faster way to make costly mistakes.

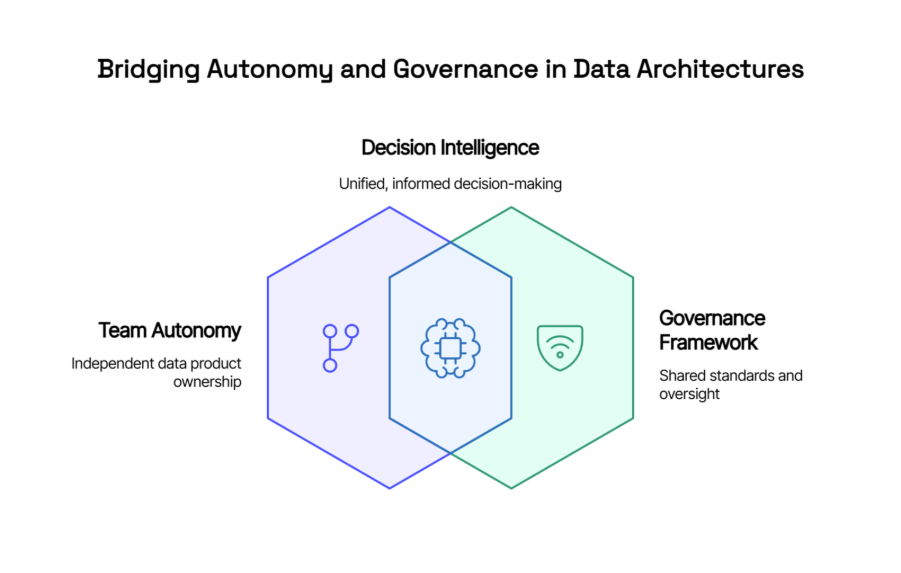

In modern data architectures, each functional team owns its own “data product,” with full autonomy in managing and evolving it. Yet autonomy only works if it lives inside an overarching governance framework that guarantees interoperability, quality, and security. Enterprise decision-making faces the same paradox: teams need the freedom to act, but inside a modular system governed by shared standards and financial discipline.

Closing this governance gap requires a new layer in the stack: Decision Intelligence.

This is the financial command system that lets autonomy coexist with discipline. In essence, a Decision Intelligence platform models, executes, and monitors decisions across functions, providing the governance finance needs.

Natzka’s platform connects operational data, maintains a live model of the business, and ties actions to financial outcomes. Instead of static analysis, finance works inside a living digital twin, a working model of how demand, supply, and pricing drive cash and profit.

Leaders can test a move, see its second or even third-order effects, and then act with guardrails and business rules that hold the line on ROI and cash flow.

The bottom line

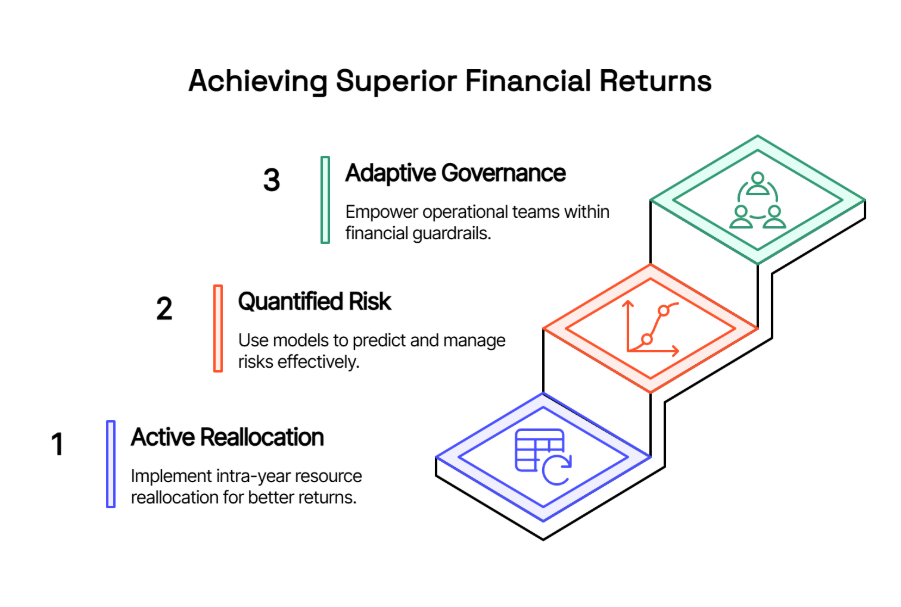

For the corner office holders, this translates into direct impact on the P&L:

- Active, intra-year reallocation correlates with superior returns; a Decision Intelligence stack makes this feasible at shorter intervals.

- Quantified risk replaces hopeful resilience. Model supplier failure/demand shifts to see inventory, cash and margin impacts.

- Adaptive governance replaces central bottlenecks. Finance sets financial guardrails, and operational teams act with freedom inside those limits, ensuring their decisions are measured against enterprise targets.

The market is forcing modularity. Will run it with spreadsheets and good intentions, or with a system that connects every action to the financial outcomes you control?

The exclusive centralised approach is no longer necessary, as with the right decision layer, you can generate meaningful outcomes from anywhere.