Data Isn’t the New Gold, the Decision Is

Data is a line item on your P&L, a cost that delivers no intrinsic return. The popular mantra that “data is the new gold” is wrong. Gold is a passive store of value. Data, until it is acted upon, is a depreciating liability. Only the decision, its accuracy, and its speed really shift EBITDA, market share, and shareholder value.

Most finance teams feel this gap every day. After multi-million-euro investments in ERPs, CRMs, and BI suites, companies still spend the majority of their week wrangling information. Industry studies indicate that the figure ranges between 60% and 80% devoted to collection and validation, leaving the remainder for the hurried interpretation of data that may already be outdated.

This is the decision latency gap: the costly delay between knowing a fact and acting on it.

This gap is where margin erodes, competitors gain ground, and opportunities are lost. It is the difference between a proactive pricing adjustment and a reactive inventory write-down.

The Widening “Decision Gap”

Your current toolkit widens this gap. Standard BI dashboards provide a clear picture of the last quarter. This is reporting, not analysis. They tell you what happened, but cannot accurately model what will happen if you change a key variable. Spreadsheets, the default for everything else, are the source of significant operational risk.

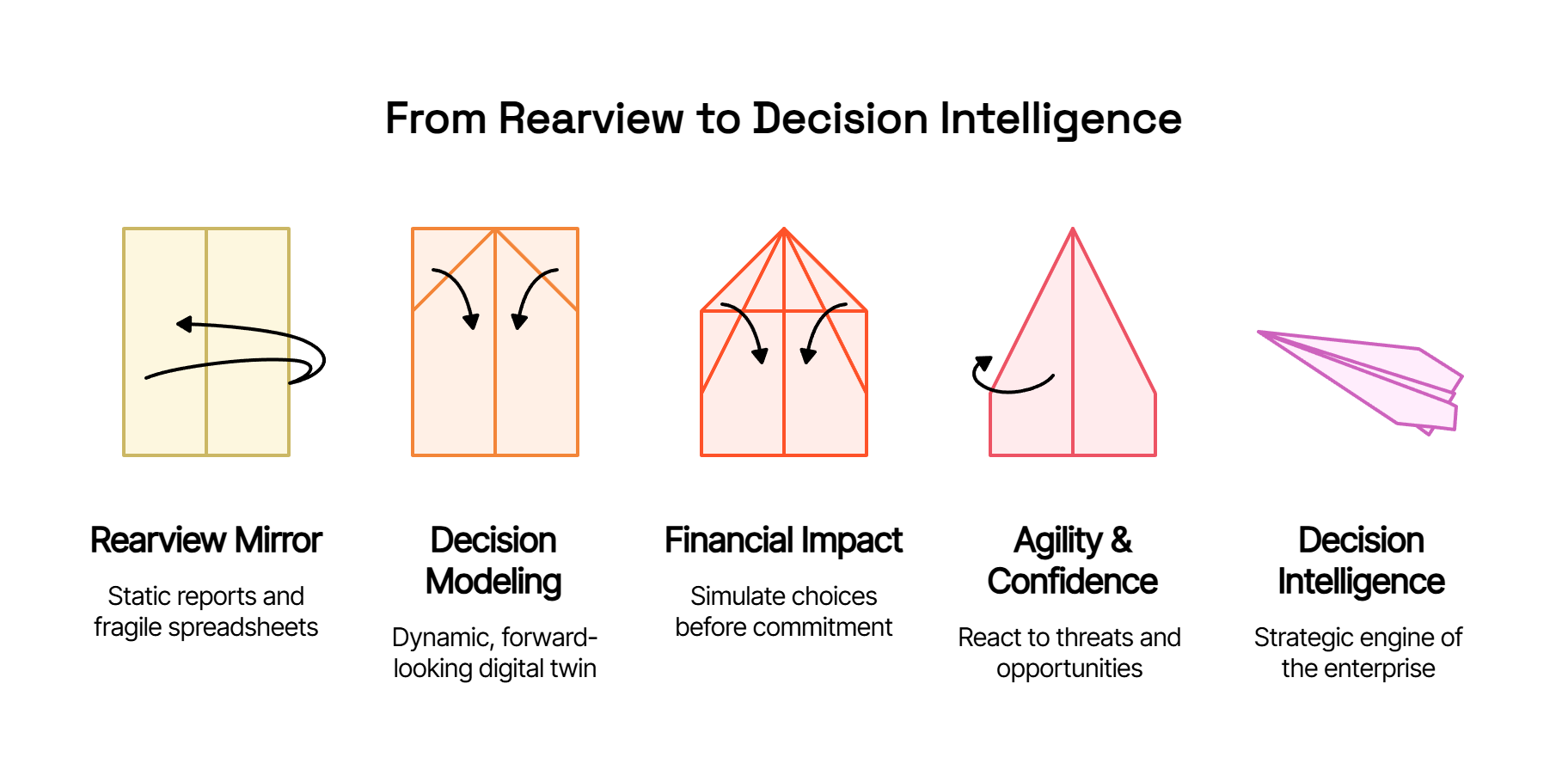

They are disconnected, error-prone, and shatter under the complexity of modern business. You cannot simulate the second-order P&L effects of a supply chain shock across 10,000 SKUs in an Excel model. In other words, they provide a rearview mirror when you need a GPS for the road ahead.

Better Decisions for Better Outcomes

To close the decision gap, you don’t need more data or another dashboard. You need a decision intelligence framework.

This is a fundamental shift from data reporting to decision modeling.

It’s about creating a dynamic, forward-looking digital twin of your business that allows you to simulate the financial impact of your choices before you commit to them. Forecast accuracy improves, budget cycles shorten, and the business gains the agility to react to both threats and opportunities with confidence

The bottom line

Companies that continue to manage by rearview mirror, relying on static reports and fragile spreadsheets, are building their future on a foundation of sand. Those that embed Decision Intelligence into their financial core will command their markets. They will turn volatility into opportunity and transform their finance function from a cost centre into the strategic engine of the enterprise.

It’s time for finance leaders to abandon the fallacy of data as gold. Stop investing in bigger vaults for your raw materials and start building the refinery. It’s time to stop mining for data and start manufacturing decisions.

See how Natzka’s Decision Intelligence platform can convert your data from a cost centre into your most powerful driver of profitable growth.